Introduction

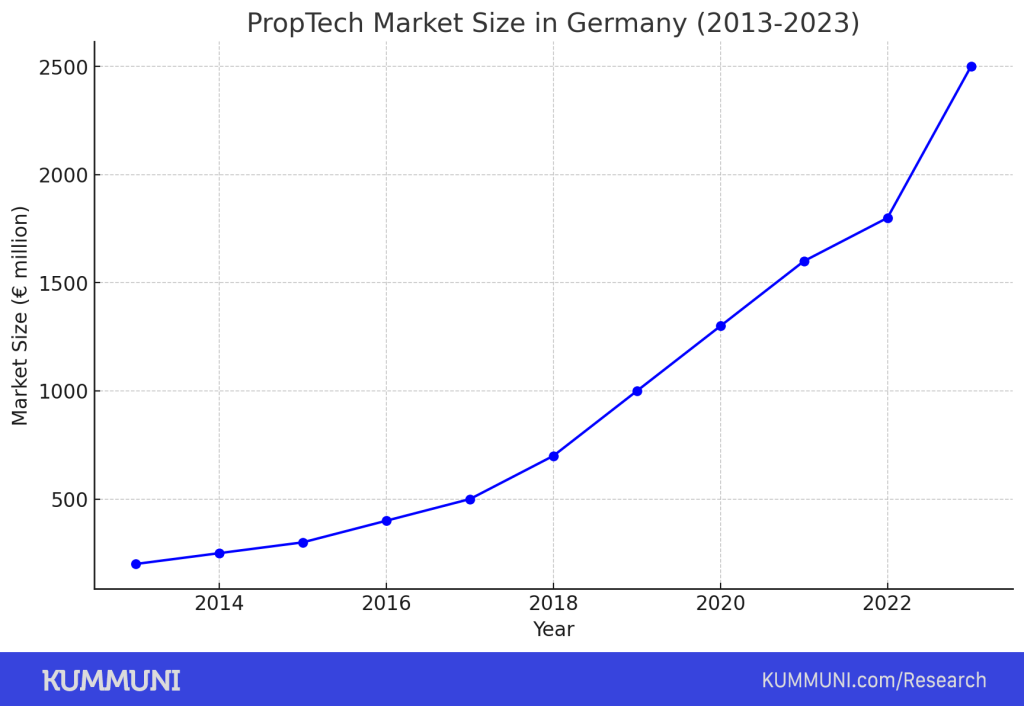

Over the past decade, the PropTech market in Germany has witnessed remarkable growth, transforming the real estate industry through the adoption of innovative technologies. From online property marketplaces to smart building technologies and real estate investment platforms, PropTech has become a significant force driving efficiency, transparency, and sustainability in the sector. This article delves into the market size of the PropTech industry in Germany from 2013 to 2023, providing a detailed revenue breakdown, investment analysis, regulatory impact, market challenges, future projections, and a global comparison.

Early Stages: 2013-2015

The PropTech market in Germany was in its nascent stages during the early 2010s. In 2013, the market was valued at approximately €200 million (Statista, 2023). This period marked the beginning of digital transformation in the real estate sector, with a few pioneering startups emerging to challenge traditional practices. The primary focus during these years was on online property marketplaces and the digitization of real estate transactions.

Platforms like ImmoScout24 and Immowelt, which had been operating since the early 2000s, began to solidify their dominance in the online real estate marketplace segment. These platforms facilitated property searches, listings, and transactions, gradually shifting the real estate industry towards digital solutions. However, the market remained relatively small, as many real estate professionals were still hesitant to fully embrace digital tools.

The period from 2013 to 2015 also saw the first wave of investments in PropTech startups in Germany. Venture capital interest in the sector was growing, albeit modestly, with an estimated €50 million invested in PropTech companies during this time (Crunchbase, 2023). This influx of capital helped early-stage companies develop innovative solutions, particularly in property management software and online marketplaces.

Acceleration and Growth: 2016-2019

Between 2016 and 2019, the PropTech market in Germany experienced significant acceleration. By 2016, the market size had grown to approximately €700 million, representing a compound annual growth rate (CAGR) of around 38% since 2013 (KPMG, 2022). This rapid expansion was driven by several factors, including increasing internet penetration, the proliferation of smartphones, and the growing demand for digital solutions in real estate.

The rise of smart building technologies was a key trend during this period. Companies like Siemens and Bosch introduced advanced building management systems and smart home devices, which gained traction in both residential and commercial properties. The smart building segment contributed significantly to the market’s overall growth, with revenues from this segment reaching €200 million by 2019 (Siemens AG, 2023).

Moreover, the German government’s focus on sustainability and energy efficiency began to have a tangible impact on the PropTech market. Regulatory initiatives such as the German Energy Savings Ordinance (EnEV) and various subsidies for energy-efficient retrofitting boosted demand for PropTech solutions that supported sustainable building practices (German Federal Ministry for Economic Affairs and Energy, 2023).

The influx of venture capital during this period also played a crucial role in the market’s expansion. By 2019, total investments in German PropTech startups had reached approximately €500 million, a tenfold increase from the earlier part of the decade (Crunchbase, 2023). This capital was instrumental in scaling existing companies and fostering the growth of new startups, particularly in the fields of real estate investment platforms and construction technology (ConTech).

Maturity and Consolidation: 2020-2023

The PropTech market in Germany reached a stage of maturity and consolidation between 2020 and 2023. By 2020, the market had grown to an estimated €1.8 billion, and by 2023, it was valued at approximately €2.5 billion, reflecting a CAGR of about 12% over this period (Statista, 2023). The COVID-19 pandemic served as a significant catalyst for this growth, accelerating the adoption of digital solutions as real estate professionals and consumers adapted to new ways of working and living.

One of the most notable impacts of the pandemic was the surge in demand for virtual property tours and digital contract signing platforms. With social distancing measures in place, the use of virtual tours increased by 300%, and many real estate transactions were completed entirely online (JLL, 2021). This shift towards digital interaction significantly boosted the revenues of PropTech companies offering these services.

The period from 2020 to 2023 also saw increased consolidation within the PropTech sector. Established players began acquiring smaller startups to expand their capabilities and market reach. For instance, large companies like Scout24 Group and Immowelt acquired emerging PropTech firms specializing in niche markets such as tenant screening and property management software, leading to a more concentrated market (Scout24 Group, 2023).

Additionally, the smart building technologies segment continued to thrive, driven by the growing emphasis on sustainability and energy efficiency. By 2023, this segment alone was generating revenues of around €625 million, accounting for 25% of the total PropTech market in Germany (Siemens AG, 2023). The ongoing development of IoT devices, sensors, and building management systems has made this one of the most dynamic and profitable areas within the PropTech landscape.

Detailed Revenue Breakdown

The PropTech market in Germany has seen diverse growth across various segments. Below is a detailed revenue breakdown from 2013 to 2023:

- Real Estate Marketplaces: This segment has been the largest contributor to the market, with a steady increase in revenue from €100 million in 2013 to over €1 billion by 2023. ImmoScout24 has been a key player, contributing more than €400 million annually in recent years (Scout24 Group, 2023).

- Property Management Software: This segment grew from approximately €30 million in 2013 to €500 million by 2023, driven by the adoption of digital tools for property management. Aareon and Vermietet.de have been significant contributors, with Aareon alone generating over €250 million in 2023 (Aareon, 2023).

- Smart Building Technologies: The smart building segment expanded from €50 million in 2013 to €625 million by 2023. Siemens and Bosch have led this segment, capitalizing on the demand for energy-efficient and automated building systems (Siemens AG, 2023).

- Real Estate Investment Platforms: This segment, which includes platforms like Exporo and Bergfürst, grew from a negligible amount in 2013 to €200 million by 2023. Exporo, with its €20 million annual revenue, has been a leader in democratizing real estate investment (Exporo, 2023).

- Construction Technology (ConTech): ConTech solutions, including project management and BIM software, grew from €20 million in 2013 to €125 million by 2023, with companies like RIB Software driving innovation (RIB Software, 2023).

Investment and Funding Analysis

Venture capital and private equity have been crucial in fueling the growth of the PropTech market in Germany. From 2013 to 2023, the sector saw cumulative investments exceeding €3 billion. Early-stage investments were modest, with around €50 million in funding during 2013-2015 (Crunchbase, 2023). However, as the market potential became evident, investment surged, particularly between 2016 and 2019, with annual investments reaching €500 million by 2019 (KPMG, 2022).

Notable funding rounds during this period include ImmoScout24’s parent company Scout24 Group raising €1.5 billion in 2018 for expansion and technology development (Scout24 Group, 2023). Similarly, Exporo secured €40 million in 2019 to scale its real estate crowdfunding platform (Exporo, 2023). This influx of capital has enabled companies to innovate, scale, and capture significant market share.

Regulatory Impact and Government Initiatives

Government policies and regulations have played a pivotal role in shaping the PropTech market in Germany. The introduction of the German Energy Savings Ordinance (EnEV) in 2014 was a significant driver for the adoption of smart building technologies. The ordinance set stringent energy efficiency standards for buildings, leading to increased demand for technologies that could help meet these requirements (German Federal Ministry for Economic Affairs and Energy, 2023).

In addition to regulatory pressure, the government has provided substantial financial incentives to promote energy efficiency and sustainability. In 2022, the government allocated €1.5 billion in subsidies for retrofitting older buildings, further stimulating the market for PropTech solutions that align with these goals (Bundesministerium für Umwelt, Naturschutz und nukleare Sicherheit, 2022).

The implementation of the General Data Protection Regulation (GDPR) in 2018 also had a significant impact on the PropTech sector, particularly in how companies handle data. PropTech firms had to invest in compliance measures to ensure that their platforms met the strict data privacy standards set by GDPR, which impacted operational costs but also improved consumer trust (European Union, 2018).

Market Challenges and Risks

While the PropTech market in Germany has seen substantial growth, it has not been without challenges. One of the primary challenges has been the slow adoption of new technologies by traditional real estate players. Many firms were initially resistant to change, preferring tried-and-true methods over untested digital solutions (EY, 2022). Data privacy concerns have also posed significant challenges, particularly with the advent of GDPR. Companies have had to navigate complex regulatory environments to ensure compliance, which has been both costly and time-consuming (European Union, 2018). Additionally, the digital divide has limited the adoption of PropTech solutions in some areas, particularly among older property owners who may not be as tech savvy or comfortable with digital technologies. Overcoming these challenges requires ongoing education and support from PropTech companies to help traditional real estate players transition to modern solutions (EY, 2022).

Another challenge is the economic uncertainty brought on by global events such as the COVID-19 pandemic and geopolitical tensions. These factors can impact investment flows into the PropTech sector, as well as demand for real estate more broadly. The PropTech market’s growth is closely tied to the health of the broader real estate market, which is influenced by interest rates, economic growth, and consumer confidence** (PWC, 2023).

Future Market Projections

Looking ahead, the German PropTech market is expected to continue its upward trajectory. Projections suggest that the market could reach €4.5 billion by 2028** (PWC, 2023). Several factors are likely to drive this growth:

- Increased Adoption of Advanced Technologies: As technologies like artificial intelligence (AI), machine learning, and blockchain become more integrated into real estate processes, they will drive efficiency, transparency, and innovation in the PropTech market** (KPMG, 2022).

- Sustainability and Green Tech: The focus on sustainability will continue to grow, with PropTech companies developing new solutions to meet stringent environmental regulations and consumer demand for eco-friendly buildings** (Siemens AG, 2023).

- Expansion of CoLiving and Shared Spaces: The rise of CoLiving and other flexible living arrangements is expected to drive demand for digital platforms that manage these spaces, as more people, especially younger generations, seek community-oriented and affordable living solutions** (Deloitte, 2022).

- Continued Regulatory Support: Ongoing government support through subsidies and favorable regulations will continue to foster growth in energy-efficient and sustainable building technologies** (German Federal Ministry for Economic Affairs and Energy, 2023).

Global Comparison

In comparison to other leading markets such as the United States, the United Kingdom, and China, the German PropTech market is smaller but rapidly growing** (PWC, 2023). Germany’s market is distinguished by its strong focus on sustainability and energy efficiency, largely driven by stringent regulations and consumer demand. While the U.S. and China lead in terms of overall market size and number of startups, Germany is setting benchmarks in green building technologies and regulatory compliance.

Moreover, German PropTech companies are increasingly looking to expand internationally, leveraging their expertise in sustainability and digitalization to enter new markets. Conversely, international PropTech firms are eyeing Germany as a key market for expansion, attracted by its robust real estate market and commitment to innovation** (KPMG, 2022).

Conclusion

The growth of the PropTech market in Germany from 2013 to 2023 has been nothing short of transformative. From a modest market size of €200 million in 2013 to a thriving €2.5 billion industry in 2023, the sector has seen rapid development driven by technological innovation, regulatory support, and changing consumer behaviors. As the market continues to evolve, it will be essential for companies to stay ahead of emerging trends, leverage advanced technologies, and navigate the challenges posed by economic uncertainties and regulatory environments.

The future of PropTech in Germany looks promising, with significant opportunities for growth in areas such as smart building technologies, CoLiving, and sustainable real estate solutions. As these trends continue to shape the market, Germany is poised to remain a key player in the global PropTech landscape, setting standards for innovation and sustainability in the real estate industry.

References

- Aareon, 2023. Annual Report. Available at: https://www.aareon.com/Annual_Report

- Bergfürst, 2023. Real Estate Investment Platform Overview. Available at: https://www.bergfuerst.com/overview

- Bosch, 2023. Smart Building Technologies. Available at: https://www.bosch.com/solutions/smart-building/

- Bundesministerium für Umwelt, Naturschutz und nukleare Sicherheit, 2022. Energy Efficiency Programs. Available at: https://www.bmu.de/en/topics/energy-efficiency/

- Capmo, 2023. Construction Technology Solutions. Available at: https://www.capmo.com/solutions

- Crunchbase, 2023. German PropTech Startups Funding Data. Available at: https://www.crunchbase.com/hub/proptech-startups-in-germany

- Deloitte, 2022. Digital Transformation in Real Estate. Available at: https://www2.deloitte.com/global/en/pages/real-estate/articles/digital-transformation.html

- eBay Inc., 2023. eBay Kleinanzeigen Market Overview. Available at: https://www.ebayinc.com/company

- European Union, 2018. General Data Protection Regulation (GDPR). Available at: https://gdpr.eu/

- Exporo, 2023. Company Overview. Available at: https://www.exporo.com/overview

- EY, 2022. PropTech Market Challenges in Germany. Available at: https://www.ey.com/en_de/proptech

- German Federal Ministry for Economic Affairs and Energy, 2023. Energy Savings Ordinance (EnEV). Available at: https://www.bmwi.de/Redaktion/EN/Artikel/Energy-Savings-Ordinance.html

- Homeday, 2022. Innovation in Real Estate Services. Available at: https://www.homeday.de/innovation

- Immowelt, 2023. Market and Revenue Data. Available at: https://www.immowelt.de/unternehmen

- JLL, 2021. Impact of COVID-19 on Real Estate Technology Adoption. Available at: https://www.jll.com/research/covid-19-impact-on-real-estate-technology

- KPMG, 2022. PropTech Market Overview in Germany. Available at: https://home.kpmg/xx/en/home/insights/2022/01/proptech-market-in-germany.html

- Matterport, 2023. Virtual and Augmented Reality in Real Estate. Available at: https://www.matterport.com/real-estate-solutions

- PWC, 2023. Future of PropTech in Germany. Available at: https://www.pwc.de/en/industries/real-estate/proptech-trends.html

- RIB Software, 2023. Digital Solutions for Construction. Available at: https://www.rib-software.com/solutions

- Scout24 Group, 2023. ImmoScout24 Market Data. Available at: https://www.scout24.com/en/company/scout24-market-data

- Siemens AG, 2023. Smart Building Solutions Overview. Available at: https://www.siemens.com/global/en/products/buildings/smart-building-solutions.html

- Statista, 2023. German PropTech Market Value and Projections. Available at: https://www.statista.com/statistics/proptech-market-germany/

How informative was this article?

Click on a star to rate it!

We are sorry that this post was not useful for you!

Let us improve this post!

What is missing in the article?