Best Blocked Account in Germany: A Comprehensive Comparison of Fintiba, Expatrio, and Coracle

Best blocked account in Germany is a common search for international students and expats planning to move to Germany. A blocked account, or Sperrkonto, is an essential requirement for non-EU residents who need to prove financial stability to German immigration authorities when applying for a student visa or residence permit.

These accounts ensure that visa applicants have enough funds to support themselves during their stay, with the German government requiring a minimum of €11,904 to be deposited into the account. This sum allows for a monthly withdrawal of €992, deemed sufficient to cover living expenses such as rent, food, and transportation.

Three major providers stand out in this space: Fintiba, Expatrio, and Coracle. Each offers different benefits, fees, and services tailored to international students and expats. In this article, we’ll provide an in-depth comparison of these three providers to help you make an informed decision about the best blocked account in Germany.

German Blocked Account Providers Compared at a Glance

| Feature | Fintiba | Expatrio | Coracle |

|---|---|---|---|

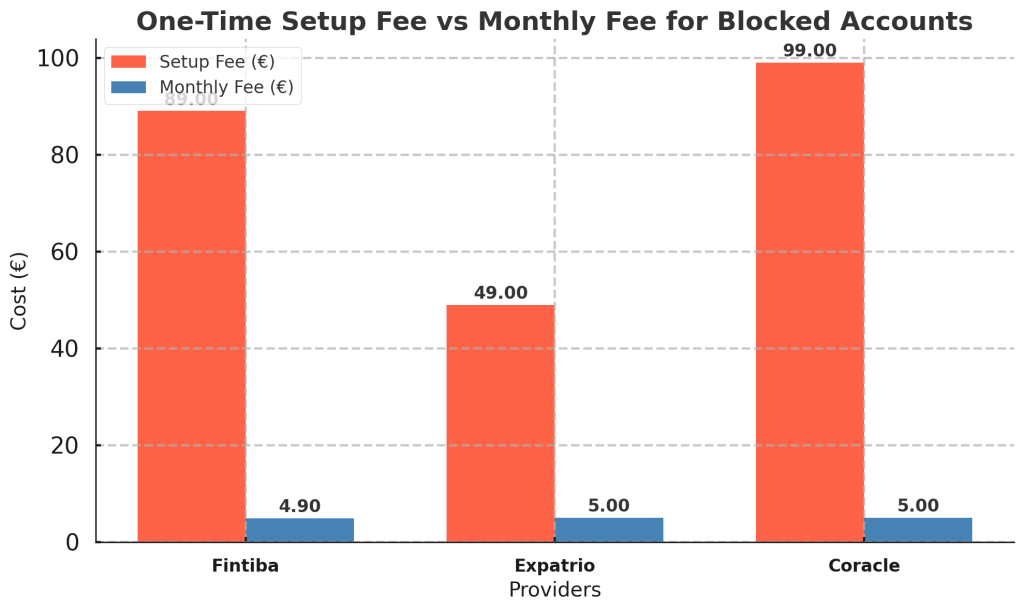

| Setup Fee | €89 | €69 | €99 |

| Monthly Fee | €4.90 | €5 | €5 |

| Processing Speed | Moderate | Fast | Very Fast |

| Bundled Insurance | Yes | Yes | Yes |

| Visa Support | Limited | Strong | Basic |

| Mobile App | Yes | Limited | No |

| Platform Type | Fully Digital | Fully Digital | Fully Digital |

| Customer Support | Multi-language | Multi-language | Personalized |

| Reputation | Well-known | Trusted | Growing |

Fintiba, Expatrio, and Coracle: An Overview

Before diving into the specifics, let’s first introduce the three key players in the blocked account market:

- Fintiba: Founded in 2016, Fintiba is one of the most popular blocked account providers for students and expats. They partner with Sutor Bank and offer a fully digital platform, simplifying the process of opening and managing a blocked account. Fintiba also offers health insurance and other student services.

- Expatrio: Another leading provider, Expatrio, is known for its user-friendly interface and comprehensive services that go beyond blocked accounts, offering health insurance, travel insurance, and student packages. Their fully digital service makes it easy for international students to set up their accounts remotely.

- Coracle: The newest of the three, Coracle, offers a straightforward and quick online process for opening a blocked account. While smaller than Fintiba and Expatrio, Coracle is steadily gaining popularity for its simplicity, transparent pricing, and efficient customer service.

Features and Services

Each of these providers offers more than just a blocked account, bundling in additional services like health insurance, visa assistance, and support for international students. Let’s break down the features offered by each:

Fintiba Blocked Account

- Health Insurance: Fintiba offers both public and private health insurance options, ensuring students have coverage that complies with German regulations. This is particularly important because health insurance is mandatory for all students in Germany.

- Digital Platform: Fintiba’s fully digital process is one of its biggest selling points. Users can apply for and manage their blocked account from anywhere in the world without the need for physical paperwork or in-person visits.

- Multi-Language Support: Fintiba’s platform is available in multiple languages, making it accessible to students from different countries.

- Mobile App: Fintiba offers a mobile app that allows users to check their blocked account balance, view transactions, and access customer support.

- Partnered with Sutor Bank: Fintiba works with Sutor Bank, a reputable German bank that manages the actual funds in your blocked account. This ensures compliance with German visa requirements.

Expatrio Blocked Account

- Bundled Services: Expatrio is well known for its bundled packages, offering blocked accounts, health insurance, and travel insurance in one place. This makes it a convenient one-stop solution for international students who need to meet multiple visa requirements.

- Visa Application Assistance: Expatrio provides additional services to help students with their visa application process, offering guidance and assistance to ensure a smooth transition to Germany.

- Public and Private Health Insurance: Like Fintiba, Expatrio offers both public and private health insurance options, ensuring that students are fully covered.

- Digital Application: Expatrio’s application process is fully digital, allowing students to set up their blocked accounts remotely and complete the necessary paperwork online.

- User Dashboard: Expatrio provides a detailed user dashboard where students can track their monthly payouts, check their health insurance status, and manage other services.

Coracle Blocked Account

- Simple Setup: Coracle’s strength lies in its simplicity. The entire process of opening a blocked account can be completed online in a few easy steps, making it a great choice for students who want a no-frills service.

- Transparent Pricing: Coracle is known for its transparent pricing with no hidden fees, which appeals to students who are budget-conscious.

- Quick Processing: Coracle prides itself on its fast processing times, making it ideal for students who need to open a blocked account quickly to meet visa deadlines.

- Digital-Only: Like Fintiba and Expatrio, Coracle offers a fully digital application and management process, removing the need for physical paperwork or in-person appointments.

- Cost-Effective Bundles: Coracle offers additional services such as health insurance, making it a convenient option for students who need multiple visa-related services in one package.

Fees and Costs

One of the most important considerations when choosing a blocked account provider is the fee structure. While all three providers offer competitive pricing, there are subtle differences in how much they charge for setup and monthly maintenance.

Fintiba Fees

- Setup Fee: €89

- Monthly Maintenance Fee: €4.90

- Additional Services: Fintiba offers health insurance and other student services, but these come with additional fees depending on the package you choose.

Expatrio Fees

- Setup Fee: €49

- Monthly Maintenance Fee: €5

- Additional Services: Expatrio offers bundled packages, which can be cost-effective for students who need health insurance, travel insurance, and blocked accounts. Bundling services may lead to savings compared to purchasing each service separately.

Coracle Fees

- Setup Fee: €99

- Monthly Maintenance Fee: €5

- Additional Services: Coracle offers simple, cost-effective bundles with transparent pricing. While the setup fee is slightly higher than Expatrio’s, Coracle provides value through its simplicity and straightforward pricing.

Application Process

Each provider has a fully digital application process, but there are minor differences in how they handle it:

Fintiba’s Application Process

Fintiba’s application process is entirely online and easy to navigate. After creating an account on their platform, you will need to provide your passport and other personal information. Once your account is verified, you’ll be able to transfer the required funds into your blocked account. After arriving in Germany, you’ll need to open a local German bank account, and Fintiba will transfer the monthly payouts from your blocked account to this local account.

Expatrio’s Application Process

Expatrio’s application process is also fully digital. Once you register on their platform, you will be asked to submit documents like your passport and university admission letter. After approval, you can transfer the required funds to the blocked account. Expatrio offers an integrated dashboard where you can manage not only your blocked account but also health insurance and other services. The monthly payouts are transferred to your German bank account after arrival.

Coracle’s Application Process

Coracle is known for its fast and simple setup. Like Fintiba and Expatrio, the process is fully digital, allowing you to submit your documents online. After transferring the required funds, you can begin receiving your monthly payouts upon your arrival in Germany. Coracle’s straightforward interface makes it easy to manage your account with minimal hassle.

Customer Support

Effective customer support is crucial for international students, especially when dealing with financial services in a foreign country. Here’s how each provider performs in this area:

Fintiba Customer Support

Fintiba offers multi-language support through various channels, including email and phone. Their mobile app also provides quick access to customer service. Users report that Fintiba’s customer service is responsive, but some have noted that wait times can vary during peak periods (such as the beginning of academic semesters).

Expatrio Customer Support

Expatrio prides itself on offering comprehensive customer support, including help with the visa application process. Like Fintiba, they provide multi-language support and are available via email and phone. Many users appreciate the hands-on assistance offered through Expatrio’s visa guidance, which adds an extra layer of service compared to some competitors.

Coracle Customer Support

Coracle, being a smaller player, offers more personalized customer support. While they may not have the extensive resources of Fintiba or Expatrio, users have praised Coracle for their responsiveness and willingness to assist with any issues. Support is available through email and chat, and responses are typically quick.

Pros and Cons of Each Provider

Fintiba Pros:

- Easy-to-use mobile app.

- Fully digital process with health insurance options.

- Well-established reputation.

Fintiba Cons:

- Higher setup fee compared to Expatrio.

- Customer service can be slow during peak times.

Expatrio Pros:

- Cost-effective bundles (blocked account + insurance).

- Comprehensive visa and relocation support.

- Lower setup fee.

Expatrio Cons:

- Slightly higher monthly maintenance fee than Fintiba.

- Limited mobile app functionality compared to Fintiba.

Coracle Pros:

- Simple, fast, and transparent setup.

- Great for budget-conscious students.

- Personalized customer service.

Coracle Cons:

- Smaller player, so fewer resources than Fintiba or Expatrio.

- Higher setup fee than Expatrio.

What Is the Best Blocked Account in Germany?

Choosing the best blocked account in Germany depends on your individual needs. Fintiba, Expatrio, and Coracle all offer competitive services that cater to different priorities. If you value simplicity and speed, Coracle may be the best fit. If you need comprehensive visa support and bundled services, Expatrio could be the right choice. For those seeking a well-established provider with extensive features, Fintiba offers reliability and convenience.

While we haven’t chosen a definitive winner, this comparison should give you the tools to choose the blocked account provider that best suits your needs as you prepare for your journey to Germany.

How informative was this article?

Click on a star to rate it!

We are sorry that this post was not useful for you!

Let us improve this post!

What is missing in the article?