Is Sparkasse a Good Bank? A Comprehensive Review and Comparison for Expats, Students, and Young Professionals in Germany

- Is Sparkasse a Good Bank? A Comprehensive Review and Comparison for Expats, Students, and Young Professionals in Germany

- Overview of Sparkasse: Germany’s Community-Centric Bank

- Sparkasse’s Account Options: What’s Available?

- Sparkasse Personal Loans: Flexible Financing Options for Every Need

- Sparkasse Credit Cards: Options to Suit Various Spending Needs

- Digital Banking and Mobile App: How User-Friendly Is Sparkasse?

- Pros and Cons of Banking with Sparkasse

- Customer Service and Accessibility: Sparkasse’s Strength in Local Banking

- Is Sparkasse a Good Bank?

Sparkasse is one of Germany’s oldest and most widely recognized banking institutions, known for its strong community orientation and reliable services. With a variety of account options, credit cards, loans, and additional financial products, Sparkasse caters to a wide range of customers, from students and young professionals to long-term residents and expats. This review dives into the key features of Sparkasse, exploring whether it’s the right choice for newcomers to Germany, comparing it to other major banks, and assessing its fees, customer service, and digital banking experience.

Overview of Sparkasse: Germany’s Community-Centric Bank

Sparkasse, founded in 1778, operates as a decentralized network of savings banks across Germany. Each branch operates independently, tailoring services to local community needs, which creates a personalized banking experience but also leads to variations in fees, account conditions, and customer service. This unique approach allows Sparkasse to cater to region-specific requirements, making it an appealing choice for individuals looking for a bank with a strong local presence and personalized service.

Key Facts about Sparkasse:

- Founded: 1778

- Branches: Over 400 in Germany

- Services: Savings accounts, current accounts, loans, mortgages, credit cards, and insurance

- Ideal For: Students, expats, freelancers, young professionals, families, and anyone looking for accessible, community-focused banking

Sparkasse’s Account Options: What’s Available?

Sparkasse provides several account types to meet a variety of banking needs, from basic current accounts to specialized options for students and long-term savings.

1. Girokonto (Current Account)

- Purpose: Ideal for everyday banking needs like bill payments, salary deposits, and daily expenses.

- Features: Includes a Girocard (German debit card), access to online banking, mobile app functionality, and options for setting up direct debits.

- Fees: Monthly fees range from €3 to €7, depending on the specific branch and account type, with some fee waivers available for younger customers or those with regular deposits.

- Pros: Convenient, widely accepted Girocard, reliable customer support, and easy access to ATMs.

- Cons: Monthly maintenance fees can be higher than those of online-only banks, and international transaction fees may apply.

2. Student Account

- Purpose: Tailored for students and young adults, providing essential banking features with few or no fees.

- Features: Includes a Girocard, free ATM access at Sparkasse ATMs, online banking, and promotional benefits like occasional discounts.

- Fees: Typically free for students under 27, though benefits and conditions can vary by branch.

- Pros: Cost-effective (often fee-free), easy account management, and specialized support for students.

- Cons: Limited features compared to full Girokonto accounts, and international student support can vary by branch.

3. Sparkonto (Savings Account)

- Purpose: Designed for those who want to save securely with modest interest.

- Features: Deposit account with secure, guaranteed savings, although interest rates are relatively low.

- Fees: Generally free, though some branches may have minimum deposit requirements or limitations on withdrawals.

- Pros: Safe way to store savings, with security through deposit insurance.

- Cons: Interest rates are typically low compared to online savings accounts or investment products.

Sparkasse Personal Loans: Flexible Financing Options for Every Need

In addition to its basic banking services, Sparkasse provides a variety of personal loans to cover a range of financial needs. Whether you’re looking to finance a home renovation, purchase a vehicle, consolidate debt, or cover emergency expenses, Sparkasse offers flexible loans tailored to your situation.

- Interest Rates: Rates are determined by each branch and are often based on individual creditworthiness, making it essential to check with your local Sparkasse for specific rates.

- Loan Amounts: Sparkasse offers a range of loan amounts, which are generally capped based on the applicant’s income, credit history, and other financial factors.

- Repayment Terms: Customers can select from flexible repayment plans, with options for both short-term and long-term payment schedules.

- Special Loan Types: Sparkasse provides specialized loans, such as renovation loans and educational loans, which may have different terms to better suit their specific purposes.

Pros of Sparkasse Loans:

- Flexible Terms: Borrowers can choose repayment schedules that align with their financial situation.

- Personalized Advice: In-person consultations offer tailored guidance, helping clients understand loan terms and repayment expectations.

- Community-Dependent Rates: Loan rates and terms reflect regional economic conditions, allowing for a more localized approach.

Cons of Sparkasse Loans:

- Variable Interest Rates: Rates can be higher than those offered by online lenders, particularly for applicants with limited or new credit histories.

- Branch-Specific Conditions: Due to Sparkasse’s decentralized nature, loan availability and conditions may vary by branch, leading to inconsistencies in experience for borrowers.

Sparkasse Credit Cards: Options to Suit Various Spending Needs

Sparkasse offers a range of credit card options to fit the diverse spending habits and financial needs of its customers. Available as Visa or Mastercard, Sparkasse credit cards come in several varieties, allowing customers to choose the card that best suits their lifestyle.

- Standard Credit Card

- Annual Fee: Between €20 and €30, depending on the branch.

- Features: Provides a basic credit limit, contactless payments, and online shopping protection.

- Best For: Those looking for a straightforward card for occasional use and online transactions.

- Gold Credit Card

- Annual Fee: Typically €70 to €90.

- Features: Higher credit limit, travel insurance, priority customer service, and additional benefits such as cashback and reward points.

- Best For: Frequent travelers or individuals looking for added perks, including comprehensive travel insurance.

- Prepaid Card

- Annual Fee: €10 to €15, depending on the branch.

- Features: A reloadable card that functions similarly to a debit card, allowing users to spend only up to the amount deposited.

- Best For: Students and younger users who want to avoid credit debt, or anyone looking to control spending without credit checks.

Pros of Sparkasse Credit Cards:

- Flexible Options: With standard, premium, and prepaid cards, Sparkasse meets a variety of customer needs.

- Travel and Buyer Protection: Gold cardholders enjoy added benefits such as travel insurance and purchase protection, which are useful for frequent travelers.

- Local Branch Support: Customers can receive assistance directly at their local Sparkasse branch, which is helpful for resolving any issues or concerns.

Cons of Sparkasse Credit Cards:

- Higher Fees Compared to Online Cards: Annual fees can be higher than those charged by digital banks, especially for premium cards.

- Limited Benefits on Basic Cards: Standard credit cards offer fewer perks compared to more advanced options, making them less attractive to benefit-focused users.

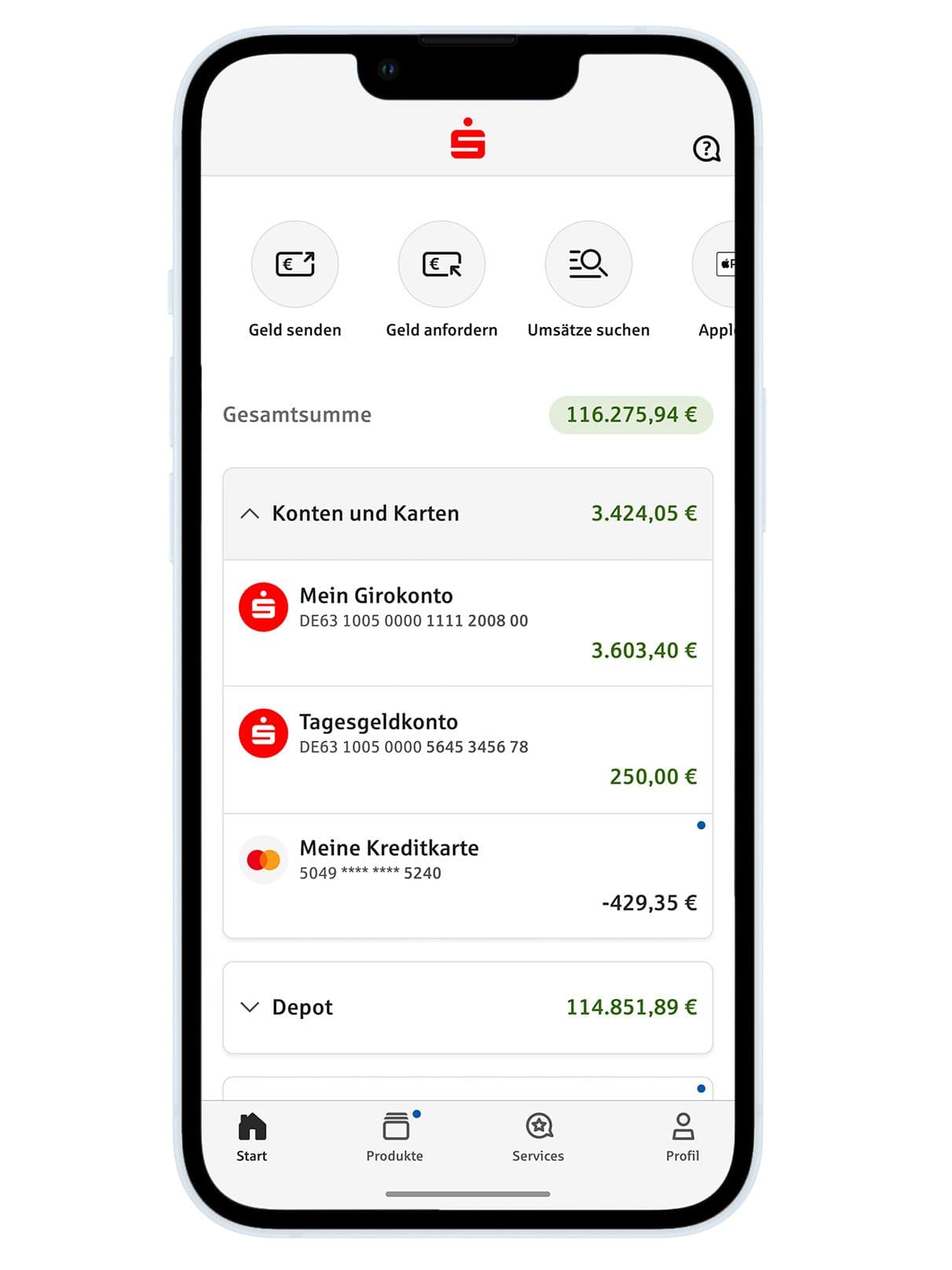

Digital Banking and Mobile App: How User-Friendly Is Sparkasse?

Sparkasse’s mobile app is designed to meet the needs of its diverse customer base, though it may feel more traditional than apps from digital-first banks. The app provides essential banking features, including balance checks, transfers, and account management, as well as some modern conveniences.

App Features:

- Account Management: Access balances, transaction histories, and manage accounts easily.

- Payments and Transfers: Conduct SEPA transfers, set up bill payments, and manage direct debits.

- Digital Wallets: Supports Apple Pay and Google Pay in certain branches, making contactless payments possible.

- Multi-Banking Option: Some branches allow users to manage accounts from other banks within the Sparkasse app, useful for those with multiple accounts.

Digital Banking Pros and Cons:

- Pros: Reliable, user-friendly for basic functions, and available on both iOS and Android.

- Cons: The app lacks some of the real-time notifications and budgeting tools that mobile-first banks offer, which may be limiting for tech-savvy users.

Pros and Cons of Banking with Sparkasse

When evaluating Sparkasse, it’s important to consider its strengths and limitations.

Pros

- Largest Branch and ATM Network: Sparkasse has the most extensive branch and ATM network in Germany, making it incredibly accessible.

- Community-Oriented Banking: Each Sparkasse branch is deeply connected to its local community, offering a level of personalization uncommon among larger national banks.

- Student-Friendly Options: Sparkasse provides accessible, often fee-free accounts for students.

- Range of Financial Services: Beyond basic banking, Sparkasse offers loans, credit cards, mortgages, and insurance, making it a full-service bank for those planning to stay in Germany long-term.

Cons

- Higher Fees on Standard Accounts: Sparkasse’s monthly fees are typically higher than those of digital-only banks.

- Digital Banking Limitations: While functional, Sparkasse’s app does not provide the same streamlined experience as mobile-first competitors.

- Regional Variations: Each branch operates independently, leading to differences in customer experience, services, and fees across regions.

Customer Service and Accessibility: Sparkasse’s Strength in Local Banking

Sparkasse’s customer service is known for its community-focused approach. Each branch is deeply connected to the local area, and staff are well-equipped to assist customers with region-specific financial needs. Expats, particularly in larger cities, will find that many branches offer English-speaking support, which can make the transition to German banking smoother.

Is Sparkasse a Good Bank?

Overall, Sparkasse is an excellent choice for those who value in-person support, a strong community focus, and comprehensive services beyond basic banking. Its network of ATMs and branches makes it accessible across Germany, and its diverse range of financial products, including credit cards and loans, can meet the needs of various customers.

While Sparkasse may not be the best option for tech-savvy users who prioritize digital banking, it’s well-suited for expats, students, and anyone who appreciates a reliable, established bank with a long-standing presence in German communities.

How informative was this article?

Click on a star to rate it!

We are sorry that this post was not useful for you!

Let us improve this post!

What is missing in the article?