The Minimum Wage in Germany: A Comprehensive Overview

- The Minimum Wage in Germany: A Comprehensive Overview

- What Is the Minimum Wage in Germany?

- Historical Overview of Germany’s Minimum Wage (2015–2025)

- Percentage of Workers Earning Minimum Wage

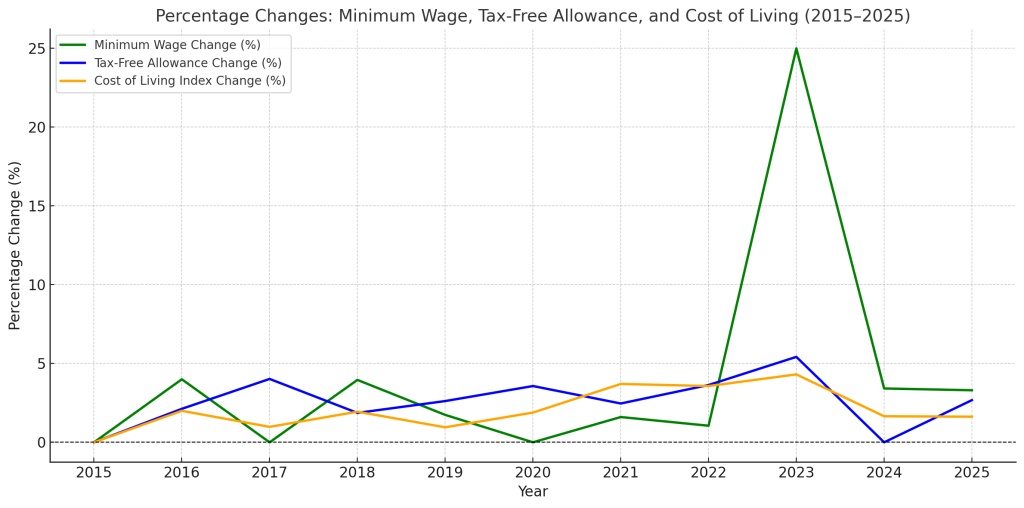

- Changes in the Cost of Living in Germany (2015–2025)

- Minimum Wage in Germany Compared to Other Countries

- Predicted Minimum Wage Growth

- Taxes and the Minimum Wage: Implications for Workers

- Economic and Social Impacts

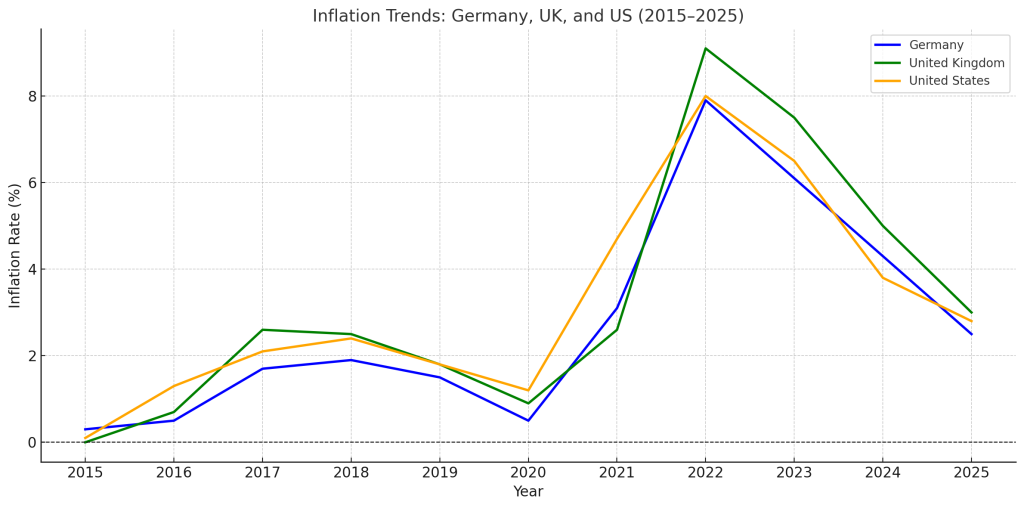

- Inflation in Germany: A Historical and Comparative Analysis (2015–2025)

- Understanding Inflation in Germany

- Inflation Trends in Germany (2015–2025)

- Comparing Inflation Trends: 2015 vs. 2025

- Implications of Inflation in Germany (2015–2025)

- Labor Problems in Germany and Economic Attractiveness

The minimum wage in Germany is a cornerstone of its labor market, affecting millions of workers and reflecting the country’s broader economic and social priorities. Since its introduction in 2015, the minimum wage has undergone periodic adjustments to keep pace with inflation, living costs, and labor market dynamics.

This article explores the minimum wage’s evolution from 2015 to 2025, its relationship with the cost of living, and its implications for workers and the economy.

What Is the Minimum Wage in Germany?

The minimum wage in Germany is the legally mandated hourly wage employers must pay most employees. It aims to prevent wage exploitation, reduce income inequality, and establish a standard for fair pay. Exemptions apply to certain groups, including apprentices, workers under 18 without vocational training, and long-term unemployed individuals in the first six months of new employment.

Historical Overview of Germany’s Minimum Wage (2015–2025)

Introduction of the Minimum Wage (2015)

- Rate: €8.50 per hour

- Purpose: To combat wage dumping and improve living standards, particularly for workers in low-paying sectors like hospitality, retail, and agriculture.

- Coverage: Over 3.7 million workers benefited immediately.

Adjustments Over the Years

The Minimum Wage Commission reviews and adjusts the minimum wage biennially based on inflation, labor market conditions, and collective bargaining agreements.

- 2017: Increased to €8.84 per hour.

- 2019: Incrementally raised to €9.35 per hour by July.

- 2021: Incrementally increased to €9.60 per hour by July.

- 2022: Substantial increase to €12.00 per hour in October.

- 2024: Adjusted to €12.41 per hour in January.

- 2025: Increased to €12.82 per hour based on current trends and inflation forecasts.

Percentage of Workers Earning Minimum Wage

Approximately 15.2% of Germany’s workforce currently earns the statutory minimum wage. This figure represents about 5.8 million employees, who predominantly work in the following sectors:

- Hospitality and Catering: Including waitstaff, hotel cleaners, and kitchen helpers.

- Retail and Commerce: Such as cashiers and stock clerks.

- Agriculture: Seasonal farmworkers.

- Logistics: Delivery drivers and warehouse workers.

Regional disparities also exist:

- In eastern Germany, around 22.2% of employees earn low wages, compared to 13.8% in western Germany.

This significant percentage highlights the importance of the minimum wage in providing a baseline income for millions of workers.

Changes in the Cost of Living in Germany (2015–2025)

The cost of living in Germany has risen significantly over the past decade due to inflation, increasing housing costs, and energy prices.

Inflation Trends

- 2015: CPI indexed at 100.

- 2020: CPI remained relatively stable but began increasing due to global economic shifts.

- 2023: CPI reached 116.7, reflecting higher consumer prices.

- 2024–2025: Inflation rates are expected to moderate at around 2.2% to 2.4%, though energy costs continue to exert upward pressure.

Housing Costs in Germany

Housing prices have grown disproportionately, impacting low-income households:

- 2015–2022: National rent prices rose by 50%, with increases up to 70% in major cities like Berlin and Munich.

- 2024: Low-income households spent over one-third of their income on rent, compared to about 20% for higher-income households.

Energy Costs in Germany

Energy prices have increased, influenced by Germany’s climate policies:

- 2025: The CO2 price is set to rise from €45 to €55 per ton, increasing costs for heating, gasoline, and utilities.

Minimum Wage in Germany Compared to Other Countries

Germany’s minimum wage is among the highest in Europe. A comparison of minimum wages in 2025 (estimated):

| Country | Hourly Minimum Wage (€) | Annual Minimum Wage (€) |

|---|---|---|

| Germany | €12.82 | €26,185 |

| France | €11.80 | €23,815 |

| Netherlands | €12.12 | €24,550 |

| United Kingdom | €12.70 | €25,725 |

| United States* | €7.25 (federal) | €15,080 |

| Poland | €4.50 | €9,360 |

Predicted Minimum Wage Growth

- Moderate Annual Adjustments:

- Germany’s minimum wage is likely to grow incrementally, influenced by inflation and economic conditions. Assuming an average annual increase of 3%–4%, the minimum wage could rise from €12.82 in 2025 to approximately €17.00–€18.00 by 2035.

- Key Drivers:

- Inflation adjustments.

- Continued political advocacy for reducing income inequality.

- Rising living costs, particularly in housing and energy.

- Potential Milestones:

- 2027: Minimum wage surpasses €14.00, reflecting higher-than-average increases due to potential economic shocks or inflation.

- 2030: Minimum wage reaches around €15.50–€16.00, aligning with the broader European trend toward higher wage floors.

- Sector-Specific Minimum Wages:

- Germany may introduce differentiated wage policies for industries struggling with labor shortages, such as healthcare and logistics, leading to slightly higher sector-specific minimum wages.

Taxes and the Minimum Wage: Implications for Workers

Income Taxes

Low-income earners benefit from Germany’s tax-free allowance, which stood at €10,908 in 2024. However, mandatory social contributions, including pension and health insurance, reduce take-home pay.

Social Contributions

Workers earning the minimum wage contribute to Germany’s social security system, including:

- Pension Insurance (18.6%)

- Health Insurance (~14.6%)

- Unemployment Insurance (2.5%)

- Long-Term Care Insurance (~3.05%)

These contributions provide long-term benefits but reduce immediate disposable income.

Economic and Social Impacts

Benefits for Workers

- Income Security: The minimum wage guarantees a baseline income, protecting workers from exploitation.

- Reduction in Inequality: It narrows the wage gap between low-income and middle-income earners.

- Improved Living Standards: Increases help workers cope with inflation and rising living costs.

Challenges for Employers

- Higher Labor Costs: Small businesses often struggle to absorb wage increases.

- Employment Patterns: Critics argue that higher wages may lead to reduced hiring or increased reliance on automation.

- Sector-Specific Pressures: Labor-intensive industries like agriculture and retail face the greatest challenges.

Inflation in Germany: A Historical and Comparative Analysis (2015–2025)

Inflation, measured by the Consumer Price Index (CPI), reflects the annual percentage change in the cost of goods and services in a country. In Germany, inflation trends over the past decade (2015–2025) have been shaped by economic, geopolitical, and environmental factors, significantly impacting the purchasing power of households and businesses.

Understanding Inflation in Germany

Inflation is a key economic indicator that measures how prices for goods and services evolve over time. Moderate inflation is typically seen as a sign of a healthy economy, whereas high or volatile inflation can erode purchasing power, destabilize markets, and harm savings. Germany’s inflation trends over the years reflect both domestic and global influences, including:

- Economic cycles: Growth periods and recessions.

- Energy prices: Volatile oil and gas prices.

- Supply chain disruptions: Particularly during the COVID-19 pandemic.

- Geopolitical factors: Such as the conflict in Ukraine, affecting energy and food costs.

Inflation Trends in Germany (2015–2025)

2015–2019: Stable Inflation

- Annual Inflation: Ranged from 0.3% (2015) to 1.5% (2019).

- Drivers: Low energy prices, moderate wage growth, and subdued economic expansion in the Eurozone kept inflation under control.

- Eurozone Context: Germany’s inflation mirrored trends across the European Union, with monetary policies from the European Central Bank (ECB) supporting price stability.

2020–2022: Pandemic and Economic Shock

- 2020: Inflation slowed to 0.5%, reflecting reduced demand during the COVID-19 lockdowns.

- 2021: Inflation spiked to 3.1%, the highest in decades, as economies reopened and supply chains struggled to meet demand.

- 2022: Inflation surged to 7.9%, driven by the energy crisis following the war in Ukraine.

2023–2025: Inflation Moderation

- 2023: Inflation moderated to 6.1% as energy prices stabilized but remained elevated.

- 2024: Inflation is projected to decrease further to 4.3%, aided by cooling global markets.

- 2025: Inflation is expected to return to more manageable levels, around 2.5%, as monetary tightening by the ECB takes effect.

Comparing Inflation Trends: 2015 vs. 2025

| Year | Inflation Rate (%) | Key Drivers |

|---|---|---|

| 2015 | 0.3 | Low energy prices, stable global markets |

| 2025 | 2.5 | Normalized energy markets, ECB interventions, steady economic growth |

The stark contrast between the stable inflation of 2015 and the elevated rates in the mid-2020s reflects significant global disruptions and policy responses.

Implications of Inflation in Germany (2015–2025)

- Impact on Households:

- High inflation, especially in 2022–2023, eroded real incomes, disproportionately affecting low-income families.

- Rising energy and housing costs contributed significantly to the financial burden on households.

- Impact on Businesses:

- Inflation increased operational costs for companies, particularly in manufacturing and logistics.

- Businesses faced challenges in passing these costs to consumers without losing competitiveness.

- Monetary Policy:

- The ECB’s low interest rates in the early 2010s supported economic recovery but contributed to higher inflation post-pandemic.

- Tightening monetary policy in 2023–2025 aims to curb inflation and stabilize prices.

Germany’s minimum wage has evolved significantly since its introduction in 2015, reflecting efforts to balance economic realities and social justice goals.

Labor Problems in Germany and Economic Attractiveness

Germany faces pressing labor market challenges driven by demographic and structural factors. These issues include a rapidly aging population, persistent skilled labor shortages, and the competition for talent in a globalized economy.

Labor Problems in Germany

- Demographic Changes:

- A declining birth rate and an aging workforce are shrinking the pool of working-age individuals. By 2035, this is expected to severely strain industries requiring physical labor and technical expertise.

- Mismatch in Skills:

- Many job seekers lack the qualifications required for high-demand sectors like IT, healthcare, and engineering. This skills gap has created bottlenecks in productivity and innovation.

- Global Talent Competition:

- Germany’s efforts to attract international talent face challenges as other countries offer competitive packages, including lower taxes and easier visa processes.

Factors Affecting Germany’s Attractiveness

- Minimum Wage:

- Recent increases in the minimum wage to €12.41 (2024) and projections for €12.82 (2025) enhance Germany’s appeal for low-income workers. However, in cities with high living costs, the gains are less impactful.

- Inflation:

- Inflation has reduced purchasing power, particularly in recent years. Stabilizing prices will be crucial to maintaining Germany’s reputation as a stable destination for workers.

- Tax System:

- While high taxes fund excellent public services like healthcare and education, they reduce disposable income, making Germany less attractive for professionals seeking higher net earnings.

While regular increases aim to protect workers’ purchasing power amid rising living costs, challenges persist for employers and low-wage sectors. By maintaining one of Europe’s highest minimum wages, Germany underscores its commitment to reducing income inequality and promoting fair labor practices.

As the country navigates future economic uncertainties, the interplay between minimum wage policies, cost-of-living adjustments, and taxation will remain pivotal in shaping the well-being of workers and the broader economy.

How informative was this article?

Click on a star to rate it!

We are sorry that this post was not useful for you!

Let us improve this post!

What is missing in the article?