SCHUFA for Foreigners: Navigating the German Credit System

- SCHUFA for Foreigners: Navigating the German Credit System

- What is SCHUFA?

- Is SCHUFA Important for Foreigners?

- SCHUFA for Foreigners: What You Should Know

- Quick Wins: Boosting Your SCHUFA Score Fast

- Long-Term Credit Management: Building a Stellar SCHUFA Score

- The Don'ts: Common Mistakes to Avoid

- Your Step-by-Step Guide to SCHUFA Success

- SCHUFA's Impact on Daily Life

- Clearing Up SCHUFA Misconceptions

- Understanding SCHUFA Scores in Germany: The Good, The Bad, and The Superb

- What Your SCHUFA Score Says About Your Financial Life

- The German Perspective: Cultural and Legal Nuances

- Alternatives and Resources

- How to Get SCHUFA for Free: A Step-by-Step Guide

- Paid SCHUFA Vs. Free SCHUFA Reports

- How Long is SCHUFA Valid?

- Final Thoughts

- How to Improve Your Schufa Score?

- 1. Check Your Schufa Report Regularly

- 2. Pay Your Bills on Time

- 3. Reduce Outstanding Debts

- 4. Avoid Multiple Credit Applications

- 5. Maintain Low Credit Utilization

- 6. Close Unused Credit Accounts

- 7. Manage Your Financial Products Wisely

- 8. Be Cautious with Your Financial Transactions

- 9. Build a Positive Credit History

- 10. Keep Your Personal Information Updated

- 11. Be Mindful of Credit Monitoring Services

- 12. Utilize a Credit Card Responsibly

- 13. Understand and Address Negative Entries

- 14. Use a Schufa-Approved Credit Counseling Service

- FAQ:

SCHUFA for foreigners is even more crucial than for those who already hold German citizenship. But why is that? Are you an expat, international student, or a newcomer to Germany? If so, you’ve likely come across the mysterious term SCHUFA, and you’re not alone in feeling confused about it. This guide will walk you through everything you need to know about SCHUFA for foreigners in Germany.

What is SCHUFA?

Understanding SCHUFA for foreigners can be tricky. SCHUFA is a German credit bureau that provides credit scores and reports for individuals and businesses. While SCHUFA is widely used by Germans, foreigners living in Germany also need SCHUFA to establish creditworthiness.

Foreigners can obtain a SCHUFA report by submitting their personal information and a copy of their passport. The SCHUFA report contains details of an individual’s credit history in Germany, including loans, credit cards, missed payments, or defaults. Having a good SCHUFA score is critical for foreigners, as it influences your ability to rent an apartment, obtain a loan, or even open a bank account. It’s highly recommended that foreigners regularly check their SCHUFA report to ensure the accuracy of their credit history.

SCHUFA is short for “Schutzgemeinschaft für allgemeine Kreditsicherung,” Germany’s main credit bureau, and it’s similar to FICO in the U.S. But SCHUFA is more than just a credit score—it’s the key to unlocking (or potentially blocking) many aspects of life in Germany.

“When I first moved to Germany, I thought SCHUFA was a type of insurance. Boy, was I wrong! SCHUFA for foreigners is everything!” – Maria, Spanish expat in Berlin

Is SCHUFA Important for Foreigners?

The answer is yes! Here’s why:

- Establishing creditworthiness: The SCHUFA report helps landlords and lenders assess your reliability. As a foreigner, having a SCHUFA report demonstrates your financial trustworthiness and your ability to pay bills on time.

- Renting an apartment: Most landlords in Germany will ask for a SCHUFA report before renting out a property. A positive SCHUFA score increases your chances of securing a place to live.

- Getting a loan or credit card: Banks and financial institutions use the SCHUFA report to evaluate loan and credit card applications. A high SCHUFA score improves your chances of approval.

- High-risk perception: For foreigners without an unrestricted residence permit, financial institutions may consider you a high-risk investment. A poor SCHUFA score further reduces your chances of getting loans or other financial assistance.

SCHUFA for Foreigners: What You Should Know

As a newcomer to Germany, you’re starting with a clean slate, which can be both an advantage and a challenge. Common hurdles include:

- Limited credit history: You’re essentially starting fresh in Germany with no prior credit record.

- Different financial system: The credit system in Germany may work differently from what you are used to in your home country.

Quick Wins: Boosting Your SCHUFA Score Fast

Here are three quick ways to build a strong SCHUFA score:

- Open a German bank account: This is the first step to integrating into the German financial system.

- Get a German credit card: Use it responsibly to build your credit history.

- Set up direct debits: Pay regular bills like rent and utilities via automatic transfers to establish reliability.

Pro Tip: If you have trouble getting a regular credit card, consider a prepaid one to start building your credit.

Long-Term Credit Management: Building a Stellar SCHUFA Score

- Pay bills on time: Set up automatic payments to ensure you never miss a due date.

- Maintain a stable address: Frequent moves can negatively affect your SCHUFA score.

- Keep credit utilization low: Use less than 30% of your available credit.

- Diversify your credit: Having different types of credit, such as installment loans and credit cards, can help improve your SCHUFA score.

The Don’ts: Common Mistakes to Avoid

- Don’t apply for multiple credits at once: This can make you look like a credit risk.

- Don’t close old accounts: The length of your credit history is important.

- Don’t ignore bills or letters: Unresolved issues can hurt your SCHUFA score.

- Don’t assume no news is good news: Check your SCHUFA regularly.

Your Step-by-Step Guide to SCHUFA Success

- Request your SCHUFA report: You’re entitled to one free report per year.

- Review for errors: Dispute any inaccuracies you find.

- Set up a German bank account: Choose a reputable bank.

- Apply for a credit card: Start with your bank or a newcomer-friendly option.

- Set up automatic payments: Ensure all regular bills are paid on time.

- Use credit responsibly: Make small, regular purchases and pay them off.

- Monitor your progress: Regularly check your SCHUFA score and adjust your strategy.

Building a solid SCHUFA score takes time, so be patient and consistent!

SCHUFA’s Impact on Daily Life

Your SCHUFA score can affect several key aspects of life in Germany:

- Renting an apartment: Landlords rely on your SCHUFA report to gauge your reliability as a tenant.

- Getting a loan: Banks use your SCHUFA score to determine your creditworthiness.

- Mobile phone contracts: Some providers require a good SCHUFA score for post-paid plans.

“I never realized how important SCHUFA was until I tried to rent an apartment. It felt like trying to get into a secret club!” – Ahmed, Syrian refugee in Munich

Clearing Up SCHUFA Misconceptions

Let’s debunk some common myths:

- Myth: Checking your own SCHUFA score lowers it.

- Fact: You can check your SCHUFA score once a year for free without any negative impact.

- Myth: All financial information is included in SCHUFA.

- Fact: SCHUFA only includes data reported by its partner companies.

- Myth: A bad SCHUFA score lasts forever.

- Fact: Negative entries are usually removed after three years.

Understanding SCHUFA Scores in Germany: The Good, The Bad, and The Superb

Imagine you’re trying to rent your dream apartment or apply for a loan to start your business in Germany. You hear the word “SCHUFA” and realize it holds the key to your financial future. But what exactly is a SCHUFA score, and how does it affect your life?

SCHUFA scores range from 0 to 100, with higher scores indicating better creditworthiness. Let’s break down what these scores mean:

- Superb (97.5% – 100%): You’re a financial superstar. Banks and landlords will love you.

- Good (95% – 97.4%): You’re in great shape. Most financial doors are open to you.

- Satisfactory (90% – 94.9%): There’s room for improvement, but you’re still creditworthy.

- Fair (80% – 89.9%): Caution: You may face higher interest rates and additional guarantees.

- Poor (below 80%): You’ll likely struggle to get loans or rentals.

What Your SCHUFA Score Says About Your Financial Life

Your SCHUFA score reveals important details about your financial habits:

- Creditworthiness: A high score shows lenders you are trustworthy.

- Loan approval: The higher the score, the better your chances of getting loans.

- Interest rates: A great score can save you thousands of euros in interest.

- Rental success: Landlords prefer tenants with high SCHUFA scores.

The German Perspective: Cultural and Legal Nuances

In Germany, financial privacy is taken very seriously. SCHUFA operates under strict data protection laws. Here’s what you need to know:

- Legal framework: SCHUFA is regulated by German data protection laws.

- Cultural attitude: Germans view a good credit score as a mark of responsibility and trustworthiness.

Alternatives and Resources

If you’re struggling with a negative SCHUFA score or haven’t established credit yet, here are some options:

- Bürgschaft: A German guarantor who vouches for you.

- Prepaid services: For things like mobile phones, prepaid plans don’t require a SCHUFA check.

- Mietkautionsversicherung: Rent deposit insurance as an alternative to a large upfront deposit.

How to Get SCHUFA for Free: A Step-by-Step Guide

You’re entitled to one free SCHUFA report per year. Here’s how to get it:

- Request the free report: Go to the meineSCHUFA website and navigate to the “Datenkopie” section.

- Fill out the form: Provide accurate personal information.

- Submit identification: Upload a copy of your passport or registration certificate.

- Wait for your report: The report will be mailed to you, typically within one to two weeks.

Paid SCHUFA Vs. Free SCHUFA Reports

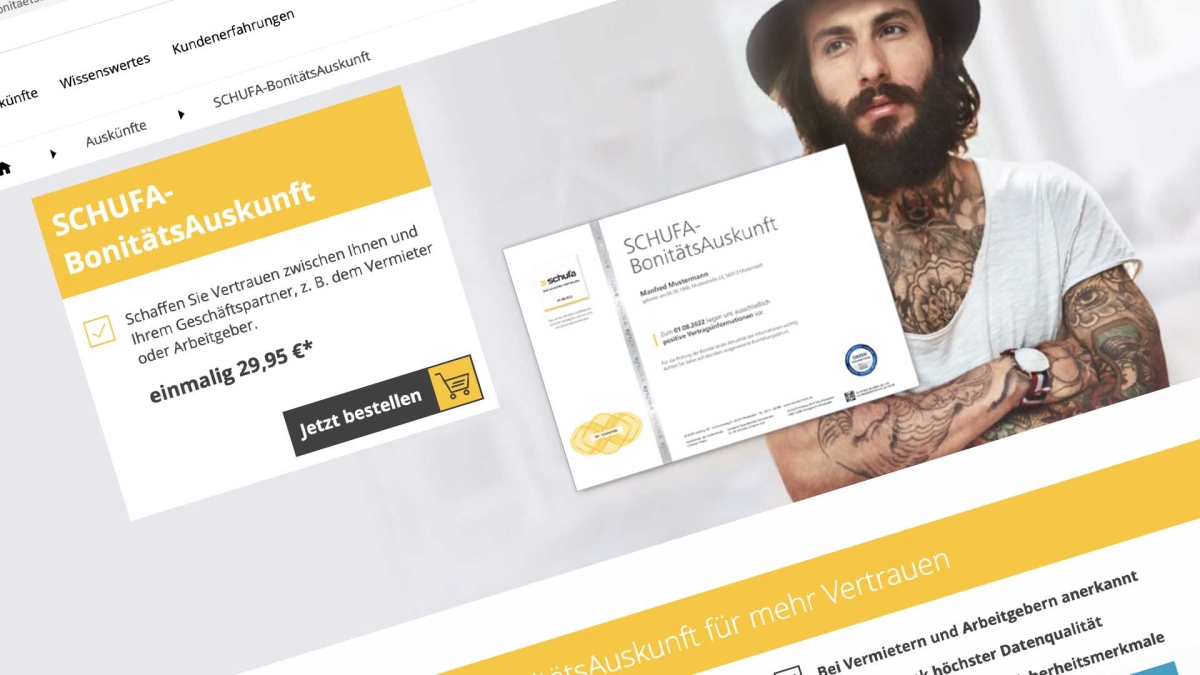

- Free report: Includes your credit information but omits the SCHUFA score. Best for personal use.

- Paid report: Includes your SCHUFA score and is necessary for things like apartment rentals. Costs about €29.95 and is available instantly online or from bank branches.

How Long is SCHUFA Valid?

Your SCHUFA score remains valid indefinitely as long as it’s accurate. However, specific entries like negative marks typically disappear after three years.

Final Thoughts

Building a good SCHUFA score takes time, patience, and careful management. By understanding how SCHUFA works and avoiding common mistakes, you can ensure that your financial standing in Germany remains strong and reliable.

How to Improve Your Schufa Score?

Improving your score, which is a crucial part of your financial health in Germany, can significantly impact your ability to secure loans, rental agreements, and even some job opportunities. Here are practical tips to help you enhance your Schufa score:

1. Check Your Schufa Report Regularly

Begin by obtaining your free Schufa report once a year. This allows you to review the data for any inaccuracies or outdated information. You can request your free report through the Schufa website or other authorized services. If you find errors, promptly contact Schufa to have them corrected. Accuracy is key to maintaining a good score.

2. Pay Your Bills on Time

Timely payment of bills and obligations is one of the most important factors affecting your Schufa score. This includes credit card bills, utility bills, and other financial commitments. Set up reminders or automatic payments to ensure you never miss a due date.

3. Reduce Outstanding Debts

High levels of outstanding debt can negatively impact your Schufa score. Prioritize paying down existing debts, focusing on those with the highest interest rates first. Aim to reduce your overall debt-to-income ratio, which demonstrates better financial health and reliability.

4. Avoid Multiple Credit Applications

Each credit application can trigger a hard inquiry on your Schufa report, which may lower your score temporarily. To prevent this, avoid applying for multiple credit products in a short period. Only apply for credit when necessary and ensure that you meet the criteria before doing so.

5. Maintain Low Credit Utilization

Your credit utilization ratio is the percentage of your available credit that you’re using. Keeping this ratio low—ideally below 30%—can positively impact your Schufa score. If possible, pay off your credit card balances in full each month or maintain a low balance relative to your credit limit.

6. Close Unused Credit Accounts

While having a long credit history can be beneficial, unused credit accounts can sometimes negatively impact your score. If you have credit cards or loan accounts that you no longer use, consider closing them, especially if they have high fees or interest rates. However, be cautious as closing accounts can affect your credit history length and utilization ratio.

7. Manage Your Financial Products Wisely

If you have existing loans or credit accounts, manage them responsibly. Regularly review the terms of your financial products and consider refinancing options if they offer better rates. This can help in reducing your monthly payments and overall debt load.

8. Be Cautious with Your Financial Transactions

When making financial decisions, such as taking out a loan or credit card, carefully consider the terms and your ability to repay. Avoid taking on more debt than you can handle. Demonstrating responsible financial behavior can improve your score over time.

9. Build a Positive Credit History

Establishing a good credit history involves using credit responsibly over time. Start with manageable credit products, such as a small credit card or a manageable loan, and ensure you make payments on time. As you build a positive history, your score is likely to improve.

10. Keep Your Personal Information Updated

Ensure that your personal details, such as your address and employment information, are current with Schufa. Accurate and up-to-date information helps in reflecting a true picture of your financial situation.

11. Be Mindful of Credit Monitoring Services

While some credit monitoring services may offer to help improve your score, be cautious and ensure they are reputable. Sometimes these services charge fees and may not always provide tangible benefits. Focus on proven methods and direct actions to improve your Schufa score.

12. Utilize a Credit Card Responsibly

Using a credit card responsibly by making regular payments and keeping balances low can positively impact your score. Avoid maxing out your credit cards, and pay off the full balance when possible. This demonstrates to lenders that you are a responsible borrower.

13. Understand and Address Negative Entries

If you have negative entries on your Schufa report, understand their nature and the steps to resolve them. Some entries, like unpaid bills or defaulted loans, may remain on your report for several years. Address them by paying off outstanding amounts and negotiating with creditors if necessary.

14. Use a Schufa-Approved Credit Counseling Service

If you’re struggling with debt or managing your finances, consider seeking help from a Schufa-approved credit counseling service. They can provide tailored advice and strategies to improve your financial situation and subsequently your Schufa score.

By following these practical tips, you can work towards improving your Schufa score and better manage your financial health. Patience and consistent responsible financial behavior are key to seeing long-term improvements in your credit score.

FAQ:

Is it possible to get free Schufa for foreigners?

Yes, by law, everyone is entitled to one free Schufa report each year. This is known as a “Datenkopie nach Art.”

What are the methods to check SCHUFA in Germany?

In Germany, you can access your Schufa information by ordering it through the SCHUFA website or by printing it at SCHUFA terminals available in Postbank and Volksbank branches. The report includes a SCHUFA certificate and a detailed overview of your personal data held by SCHUFA, along with various industry scores. Alternatively, you can subscribe to SCHUFA’s paid online service for more detailed reports.

What does SCHUFA stand for in English?

Schufa stands for “Schutzgemeinschaft für allgemeine Kreditsicherung,” which translates to “general credit protection agency” in English. When referring to a Schufa score, Schufa report, or Schufa rating, all terms related to your credit information, are commonly known as “Schufa Auskunft.”

How can I get SCHUFA free for free online?

You can check your basic SCHUFA score online for free. To receive your first credit report by post within seven days, request the free data copy. For a quick digital credit report, you can test the mySCHUFA compact service free for four weeks. Additionally, an app will soon offer access to the basic score through bonify.

How do i get a SCHUFA if I’m not from Germany?

You cannot obtain a SCHUFA report if you have never lived in Germany. SCHUFA reports are based on data collected from financial activities within Germany, so they require a history of transactions and residence in the country.

How informative was this article?

Click on a star to rate it!

We are sorry that this post was not useful for you!

Let us improve this post!

What is missing in the article?