Why Are Salaries in Germany So Low? Unpacking the Factors Behind Germany’s Wage Structure

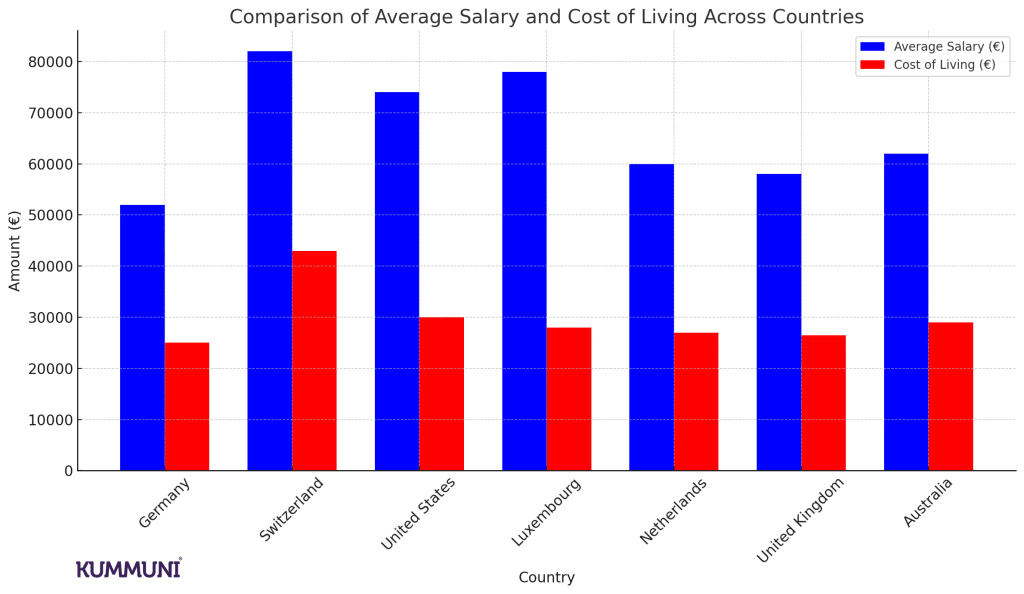

Germany’s economy is admired worldwide for its resilience and high quality of life. Yet, for many who come to live or work here, the reality of German salaries can be underwhelming. Despite Germany’s economic power, salaries can feel disproportionately low, especially when compared with neighboring countries like Switzerland or global economic giants like the United States.

On average, German workers earn around €52,000 gross annually. In comparison, salaries in Switzerland exceed €82,000, and in the United States, they often average around €74,000. Why do salaries in Germany fall short? The answer involves a blend of structural, economic, and cultural factors deeply rooted in Germany’s commitment to stability and collective welfare.

Here, we’ll examine how Germany’s socialist policies, collective bargaining systems, and cultural focus on work-life balance shape salaries. We’ll also compare Germany with countries where earnings are higher, analyze salary levels across different industries, and see how years of experience affect earnings.

German Salary Levels: Gross vs. Net Earnings

One reason for Germany’s seemingly low salaries is the impact of taxes and social contributions, which reduce gross pay significantly. Germany’s progressive tax system requires higher earners to pay a substantial percentage of their income in taxes, while mandatory contributions fund social welfare programs. These deductions mean that even a high gross salary in Germany may result in a modest net income.

High Taxes in Germany and Social Contributions

German workers pay about 40-47% of their salary toward taxes and social programs, which cover:

- Healthcare: A mandatory system providing comprehensive coverage.

- Education: Public funding for higher education reduces personal costs.

- Pensions and Retirement: Contributions go towards long-term retirement benefits.

- Unemployment Support: Unemployment insurance supports workers during job transitions.

While these contributions provide a robust safety net, they cut directly into take-home pay, giving Germany the appearance of lower wages. In contrast, workers in the United States face fewer tax burdens but must pay for essentials like healthcare out of pocket, which may even cost more over time.

German Socialist Policies and How They Impact Salaries

Germany’s economic system is rooted in a “social market economy” model, aiming to balance free enterprise with social responsibility. In practice, this model limits salary growth, focusing instead on wage stability, job security, and fair wages. While these principles support long-term stability, they may limit income potential and increase frustration among high-skill workers seeking better financial rewards.

The Trade-Off of High Tax Rates and Extensive Social Welfare

Germany’s high tax rates fund a vast network of public services:

- Universal Healthcare: Contributions ensure affordable healthcare access.

- Free Higher Education: Tax funding covers university costs, avoiding student debt.

- Social Security: Pensions and unemployment benefits offer long-term security.

Although high taxes and social contributions cover essential services, they often leave workers with reduced disposable income. While these systems ensure that no one lacks critical services, the cost is borne directly from workers’ salaries. In comparison, U.S. workers might earn more upfront, but with fewer social supports, they face higher personal costs.

Work-Life Balance and Its Impact on Salaries

Germany’s emphasis on work-life balance plays a significant role in salary structure. Unlike the U.S. or Switzerland, where longer hours and high bonuses are common, Germany’s labor market values efficiency and quality within standard working hours. This cultural approach, while beneficial for well-being, results in fewer opportunities to earn beyond one’s base salary.

Limited Overtime and Bonus Culture

German work culture prioritizes a sustainable pace, valuing family time and personal well-being. German workers often enjoy:

- Standard Working Hours: Labor laws discourage extensive overtime.

- Lower Performance Bonuses: Salaries rely on base pay, with fewer incentives.

While this structure supports a healthy work-life balance, it limits potential for higher earnings through performance-based bonuses or overtime. This leaves German workers without the supplemental earnings common in performance-driven cultures, even if they work in high-skill fields like tech or finance.

Collective Bargaining and Wage Stability in Germany

Collective bargaining is a central part of Germany’s wage structure, with unions and employers negotiating wages and conditions across industries. While collective agreements support job security and wage fairness, they can also restrict rapid wage growth in comparison to more flexible, market-driven economies.

The Impact of Collective Agreements on Salary Growth in Germany

Collective bargaining in Germany offers:

- Job Stability: Union agreements provide secure, consistent wage increases.

- Stable Wages: Unionized sectors offer predictable income but limit high earnings potential.

While unionized roles protect workers from economic fluctuations, they also limit individual earning potential, particularly in sectors like manufacturing and engineering. In high-demand industries such as finance or tech in the U.S., workers may see higher wage growth due to performance-based structures, whereas German salaries remain steady but slow-growing.

Comparing German Salaries Across Industries

German salary levels vary significantly across industries, but even high-paying sectors like finance and IT often fall short compared to other high-income countries. Let’s break down some key industries:

Finance: Comparing German and Swiss Earnings

In Germany, financial analysts earn around €60,000 to €80,000 per year. By comparison, similar roles in Switzerland pay €120,000 or more due to Switzerland’s reputation as a global finance hub. German salaries in finance, while respectable, are restrained by collective wage agreements that prioritize stability.

Technology: U.S. vs. Germany for Software Engineers

German software engineers typically earn between €55,000 and €75,000. In the U.S., software engineers in high-demand areas like Silicon Valley command €100,000–€120,000 or more. Germany’s tech industry has a stable but moderate growth curve, favoring reliability over rapid earnings increases.

Manufacturing and Engineering: Germany’s Traditional Stronghold

Germany is renowned for its automotive and engineering sectors. Experienced engineers in Germany might earn around €65,000, while their Swiss counterparts could see closer to €90,000. Even in Germany’s leading industries, collective agreements cap wages, contributing to a slower, steadier wage progression.

Experience Levels and Their Influence on Salaries

German salary growth is gradual, aligning with the country’s collective focus on stability over high risk, high reward. Let’s see how experience affects earnings in Germany.

Entry-Level Roles: Germany vs. the United States

Entry-level positions in fields like IT and engineering in Germany typically pay between €40,000 and €50,000. By comparison, U.S. entry-level salaries in tech often start around €60,000. The German system favors gradual wage growth, while U.S. employers are more likely to offer higher starting pay, especially in competitive sectors.

Mid-Level Positions: German Stability vs. Swiss Flexibility

Mid-career professionals in Germany see salaries of about €60,000–€80,000. However, in Switzerland, mid-level roles may command over €100,000, particularly in finance. Germany’s steady but modest salary growth aligns with its emphasis on social stability, often at the expense of higher salaries in the short term.

Senior and Executive Roles in Germany vs. Higher-Paying Countries

German executives earn competitive salaries, generally between €120,000 and €150,000, but their U.S. and Swiss counterparts can easily earn over €200,000. Germany’s salary progression is steady, fitting the collective model, but limits on top-end salaries frustrate professionals seeking faster financial growth.

Cost of Living and Purchasing Power in Germany

Despite lower salaries, Germany’s cost of living is generally moderate, which helps balance some of the income limitations. However, this balance is tenuous, particularly in urban centers where costs are rising.

Rising Costs and Limited Income Growth

Housing prices are climbing rapidly in cities like Munich and Berlin, while wage growth lags behind. This disconnect between cost of living and income growth demonstrates the limitations of Germany’s model, especially as cost-of-living increases affect purchasing power.

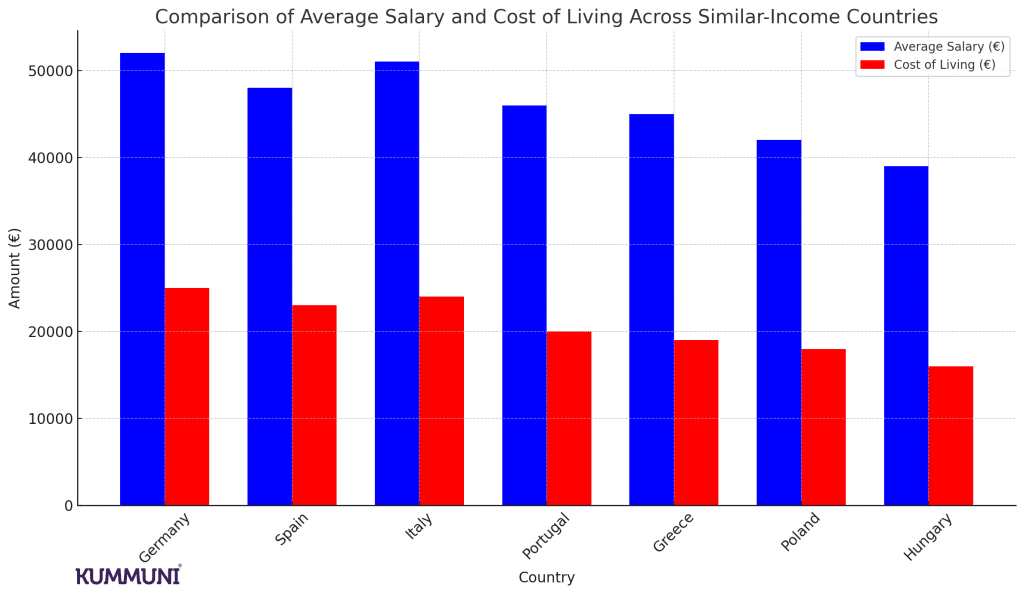

German Salaries vs. Comparable European Economies: How Do They Measure Up?

When comparing Germany’s salaries with similar European economies, it’s clear that German incomes, while steady, are not exceptionally high. Countries like Spain, Italy, Portugal, and Greece have similar income levels, often reflecting the collective, stability-focused wage structures common in many parts of Europe. For example:

- Spain: Average salaries in Spain hover around €48,000, slightly lower than Germany’s €52,000, with Spain facing similar high tax burdens and a strong public welfare system.

- Italy: Italian salaries are roughly €51,000 annually, close to Germany’s level but also impacted by high social contributions that ensure strong healthcare and pension systems.

- Portugal: At about €46,000, Portuguese salaries reflect a similar approach to Germany, with stable wages, moderate living costs, and a focus on public welfare over rapid salary growth.

- Greece and Poland: Greece offers an average salary of about €45,000, with Poland following at €42,000. Both countries’ wage systems align with Germany’s model, supporting collective well-being but leaving less room for individual income growth.

While Germany’s salaries are often slightly higher than in these countries, they are only modestly so. All of these economies emphasize long-term security, public welfare, and fair wages, contributing to stable incomes without rapid rises typical of more individual-driven economies like the U.S.

Cost of Living Comparison: Germany and Other Moderate Income European Countries

Germany’s cost of living, although moderate by European standards, is rising, especially in urban centers. When we compare Germany to countries with similar income levels, it’s evident that Germany strikes a balance between quality of life and affordability, yet this balance is shifting. Here’s how Germany compares:

- Spain: Cost of living in Spain is slightly lower than in Germany, particularly for housing. However, Spain’s limited social benefits mean personal expenses can quickly rise, offsetting the savings on daily costs.

- Italy: Italy has a comparable cost of living to Germany, especially in larger cities like Milan. However, Italy’s costs for essentials like healthcare are often higher without the same level of public funding found in Germany.

- Portugal: With a lower cost of living than Germany, Portugal is more affordable overall, but public services are less comprehensive, requiring higher out-of-pocket costs for healthcare.

- Greece: Greece’s cost of living is generally lower, but economic challenges can limit service quality and stability, impacting overall quality of life.

In Germany, strong public services keep healthcare and education costs manageable, yet housing prices in cities are climbing. These countries share similar income levels and collective-focused wage structures, but varying costs of living and public benefits influence purchasing power and quality of life in different ways.

The Structural and Cultural Roots and Impact on the German Wage Model

Germany’s “social market economy” prioritizes stability over rapid financial gains. While the system offers a secure foundation, it lacks flexibility, limiting individual income growth opportunities and emphasizing collective well-being over individual financial gain.

Germany’s Social Contract

The country’s economic model results in standardized wages across industries, offering job security but restricting wage increases. Germany’s focus on fair wages and job protections creates a predictable income structure, but it can be limiting for high-skilled professionals seeking greater financial rewards.

Cultural Values Emphasize Stability Over Earnings

In Germany, the emphasis is on job satisfaction and personal well-being rather than high salaries. German culture prizes a balanced, sustainable work environment where stability is more valuable than rapid income growth.

What Germany’s Salary Structure Means for Workers

Germany’s salary structure reflects a commitment to collective stability and social welfare. The system offers comprehensive protections and social benefits, but it restricts high-salary growth, leaving workers with limited control over their income progression. The collective model, while supportive, can feel stifling, especially for those seeking to advance quickly.

For workers accustomed to more dynamic salary structures, Germany’s model may appear restrictive. The trade-off of social protections for slower income growth can make it challenging to keep up with rising living costs. While German salaries may seem modest, they align with the country’s values of stability and collective support, though at a personal financial cost for individuals seeking more rapid wage growth.

How informative was this article?

Click on a star to rate it!

We are sorry that this post was not useful for you!

Let us improve this post!

What is missing in the article?